New Year’s Day is on January 1 every year. Although New Year’s Eve accompanies New Year’s Day, many businesses do not observe New Year’s Eve as a paid holiday because it’s not considered a legal holiday. You can choose whether or not you want to observe New Year’s Eve along with New Year’s Day at your business.

subsequently What holidays do you get time and a half? It requires private employers to pay employees time-and-a-half for working on Sundays and the following holidays:

- New Year’s Day.

- Memorial Day.

- Independence Day.

- Victory Day.

- Labor Day.

- Columbus Day.

- Veterans’ Day.

- Thanksgiving Day.

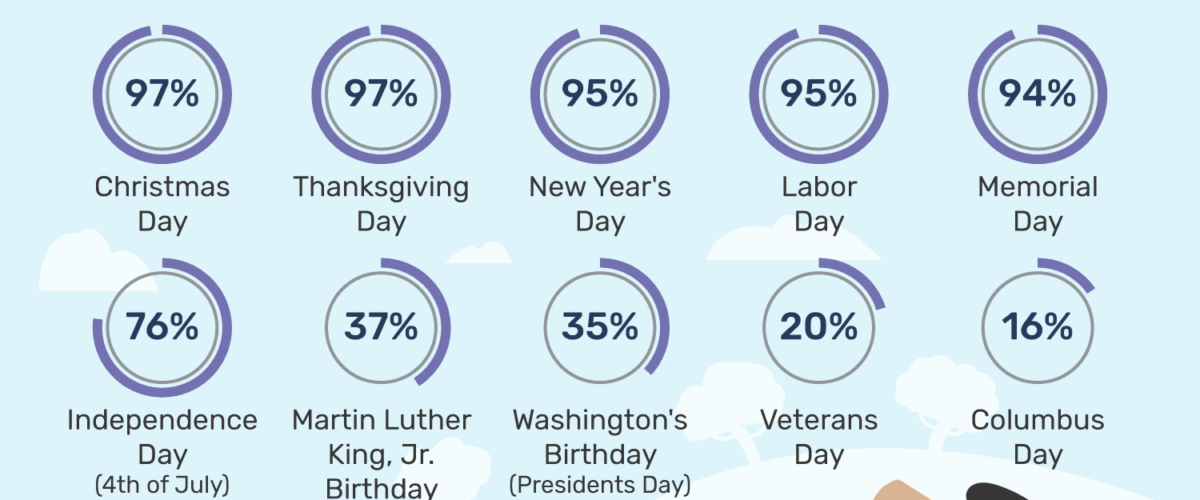

What are the 3 paid holidays? The most common paid holidays in the U.S. are:

- New Year’s Day.

- Memorial Day.

- Independence Day.

- Labor Day.

- Thanksgiving Day.

- Christmas Day.

as well Do workers get paid more on New Year’s Eve? In general, if you are a salaried worker, you will not receive extra pay or overtime for working on a holiday. Employees in retail and hospitality positions often do not receive a special holiday rate, as holiday and weekend shifts are part of their normal business hours.

What are the paid holidays for 2021?

Notes On Holidays

- New Year’s Day – January 1 st

- Martin Luther King Jr. Day – 3 rd Monday in January.

- President’s Day – 3 rd Monday in February.

- Cesar Chavez Day – March 31 st

- Memorial Day – The last Monday in May.

- Independence Day – July 4 th

- Labor Day – First Monday in September.

- Veterans Day – November 11 th

How much is holiday pay for 15 an hour? Figure the holiday pay hourly rate. Using the above example, an employee earning $30,000 per year earns an hourly rate of $15.31. Multiply $15.31 by 15 percent to arrive at the sum of $22.97. Multiply the holiday pay by the number of hours the employee works over the holiday.

identically What are the 9 major paid holidays? Holidays There are 9-1/2 paid holidays per year: New Year’s Day, President’s Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Thanksgiving Day, day after Thanksgiving, Christmas Eve, (1/2 day), Christmas Day.

Is holiday pay time and a half? If an employee works on a holiday, they are paid their usual rate of pay unless it is the employer’s policy to pay extra rates such as time-and-a-half. California law does not require the employer to pay any additional pay if an employee works on the day of a holiday unless it is part of their common practice or if the …

What are considered paid holidays?

Usual Paid Holidays

- New Year’s Day,

- Easter,

- Memorial Day,

- Independence Day (4th of July),

- Labor Day,

- Thanksgiving Day,

- Friday after Thanksgiving, and.

- Christmas Day.

What is normal holiday pay? Calculation: Normal pay per day worked x 1.5 (for time-and-a-half), or x 2 (for double-time) = Holiday Pay. Work like normal – Federal law does not require you to pay your employees extra, or above normal pay, for working on a holiday. Legally, it’s just another day where you earn the same as any other day.

How do paid holidays work?

Basic rules

If an employee paid by incentive pay works on a general holiday, they are entitled to their average daily wage plus 1.5 times the hourly wage. If an employee paid by incentive pay does not work on the general holiday, they are entitled to their average daily wage.

What do you get for holiday pay? The important thing to know is that under federal law, overtime is calculated weekly. This means if employees work over 40 hours during the week of typical paid holidays like Thanksgiving, Christmas, or New Year’s Day, they are entitled to “time and a half” for the hours worked over 40 hours.

Is Easter double pay?

2. California employers are not required to pay for time off for holidays, nor are they required to pay additional wages if employees work on holidays. Likewise, there is no requirement that employers pay employees extra pay or “holiday pay” for work performed on holidays.

Do I get paid for Good Friday?

Good Friday is a statutory holiday in Alberta, which is a paid general holiday for employees who are eligible.

How many paid holidays are there in a year? The Federal Government provides employees with 11 paid holidays each year. 1 Private sector employers may provide these holidays off with pay, holidays off without pay, or holiday pay for working on a holiday, but they are not necessarily required to offer any of these options.

Does holiday pay have to be 8 hours? There is nothing in state law that mandates an employer pay an employee a special premium for work performed on holidays, Saturdays, or Sundays, other than the overtime premium required for work in excess of eight hours in a workday or 40 hours in a workweek.

Can an employer not pay holiday pay?

Your employer has to pay you for any holiday you’re legally entitled to but haven’t taken. … You’re only entitled to be paid for it if your contract says so. If it doesn’t say anything, you’re unlikely to be paid. You could ask your employer if you can take the holiday as days off during your notice period.

Can a company not pay holiday pay? The Fair Labor Standards Act (FLSA) does not require payment for time not worked, such as vacations or holidays (federal or otherwise). These benefits are generally a matter of agreement between an employer and an employee (or the employee’s representative).

Do you get holiday pay?

There is a minimum right to paid holiday, but your employer may offer more than this. The main things you should know about holiday rights are: you are entitled to a minimum of 5.6 weeks paid annual leave (28 days for someone working five days a week) … you get paid your normal pay for your holiday.

How many holidays are you entitled to a year? The main things you should know about holiday rights are: you are entitled to a minimum of 5.6 weeks paid annual leave (28 days for someone working five days a week) those working part-time are entitled to the same level of holiday pro rata, currently this is 5.6 times your usual working week for example.

Do employer have to pay holidays?

2. California employers are not required to pay for time off for holidays, nor are they required to pay additional wages if employees work on holidays. Likewise, there is no requirement that employers pay employees extra pay or “holiday pay” for work performed on holidays.

Does everyone get holiday pay? All throughout California, many employers offer their employees holidays off with pay. Some may offer you hours that you can work on holidays, and they pay you additional holiday time wages as compensation. This arrangement sounds like a great idea, but it is not the case for everyone.

Do I get paid Easter Sunday?

Working on Easter Sunday

Easter Sunday is not a public holiday. If you are working on Easter Sunday you will be paid your normal rate – not time and a half or a paid day off (time in lieu).

Why isn’t Easter a paid holiday? Easter doesn’t have to be a federal holiday because Easter is always on Sunday, and Sundays are banking holidays in their own right. The federal holidays are also called baking holidays. Because Easter ALWAYS falls on a Sunday and Christmas can be on any day of the week.

Can an employer make you work Easter Sunday?

Many people have the right to bank holidays written into their contract with their employer. But if you don’t have this, employers can require you to work on public holidays. … In the retail sector, there are special rights relating to Sunday working (for example, Easter Sunday).

Do I get paid for Easter Sunday?

Working on Easter Sunday

Easter Sunday is not a public holiday. If you are working on Easter Sunday you will be paid your normal rate – not time and a half or a paid day off (time in lieu). You can refuse to work on Easter Sunday without giving a reason.