We present evidence on the December effect. When investors do not sell winner stocks in December but postpone their sale to January so that capital gains will not be realized in the currentfiscal year, the “winners” appreciate in December. The December effect is relatively easy to arbitrage.

subsequently What is Dec effect? The tendency of stocks to perform better in December than in any other month of the year. This may be because of increased sales and earnings due to the Christmas season, or because of expectations for new products at the start of the next year.

What month is the stock market the highest? Historically, November has been the best month of the year for the stock market – both since 1950 and over the past decade, according to LPL Financial. That’s not all. History shows the stock market’s strongest six-month period is November to April, according to the Stock Trader’s Almanac.

as well What is January anomaly? The January effect is a hypothesis that there is a seasonal anomaly in the financial market where securities’ prices increase in the month of January more than in any other month. … Another cause is the payment of year-end bonuses in January. Some of this bonus money is used to purchase stocks, driving up prices.

What is the January effect stock prices?

The January Effect is known to be a seasonal increase in stock prices throughout the month of January. The increase in demand for stocks is often preceded by a decrease in price during the month of December, often due to tax-loss harvesting.

What is Christmas rally? The Santa Claus rally is basically a tendency of the stock market to surge over the last weeks of December and the New Year. This rally may also be attributed to the flow of fresh funds from investors amid anticipation of good returns and putting into motion investment plans for the next financial year.

identically How soon can you sell a stock after buying it? If you sell a stock security too soon after purchasing it, you may commit a trading violation. The U.S. Securities and Exchange Commission (SEC) calls this violation “free-riding.” Formerly, this time frame was three days after purchasing a security, but in 2017, the SEC shortened this period to two days.

Should I buy stocks when they are low or high? Stock market mentors often advise new traders to “buy low, sell high.” However, as most observers know, high prices tend to lead to more buying. Conversely, low stock prices tend to scare off rather than attract buyers.

Should I check my stocks everyday?

Instead, you should be focusing on the long-term returns of investing. As such, you shouldn’t check your stocks daily! If you are a long term investor, you can check your stocks monthly, quarterly or once every 6 months. This is mainly to ensure that you’re on track to achieve your financial goals.

Do stocks rise in January? The January Effect is a perceived seasonal increase in stock prices during the month of January. … Another possible explanation is that investors use year-end cash bonuses to purchase investments the following month.

What is the stock market going to do in 2021?

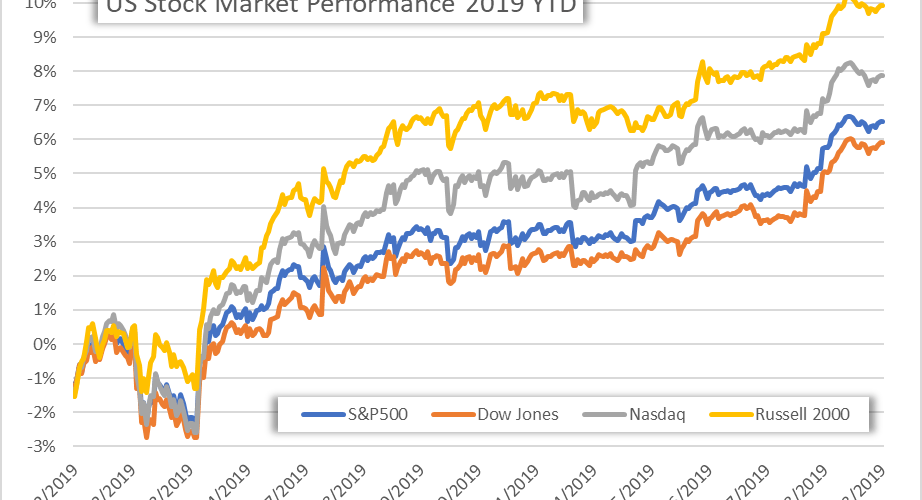

The S&P 500 finished the month at an all-time high and surged 6.9%, for its biggest monthly gain of 2021. This benchmark for the U.S. stock market is up more than 22% for the year while the Dow Jones Industrial Average, Nasdaq Composite and Russell 2000 are all up at least 16%.

What is Monday effect? The term Monday effect refers to a financial theory that suggests that stock market returns will follow the prevailing trends from the previous Friday when it opens the following Monday.

Do stocks go up at the end of the month?

Statistics show that stock prices, and in particular US stock prices, tend to go up during the last days and the first days of the month. … Investui uses the S&P 500 market index to benefit from the ‘End of Month’ effect.

Is November a good month for the stock market?

November is historically the best month of the year. According to the Stock Trader’s Almanac, the S&P 500 has gained an average of 1.7% in November since 1950. … This implies that investors should buy stocks during this bustling time in the market (read: ETF Strategies to Cheer the Market Momentum in October).

What is Santa rally in stock market? The Santa Claus rally is a very specific event. It is the tendency for the market to rise in the last five trading days of the current year and the first two days of the new year.

Can you sell a stock for a gain and then buy it back? Originally Answered: Can you sell a stock for a gain and then buy it back? Yes, and there are good reasons someone may want to do this; however, doing the exact opposite is disallowed, ie. you cannot sell stock for a loss then buy back another “substantially identical” security within 30 days before or after the sale.

Is day trading illegal?

While day trading is neither illegal nor is it unethical, it can be highly risky. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring.

Is it legal to buy and sell the same stock repeatedly? Trade Today for Tomorrow

Retail investors cannot buy and sell a stock on the same day any more than four times in a five business day period. This is known as the pattern day trader rule. Investors can avoid this rule by buying at the end of the day and selling the next day.

Is it worth buying 10 shares of a stock?

Just because you can buy a certain number of shares of a particular stock doesn’t mean you should. … Most experts tell beginners that if you’re going to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings.

What time of day are stock prices lowest? Regular trading begins at 9:30 a.m. EST, so the hour ending at 10:30 a.m. EST is often the best trading time of the day. 1 It offers the biggest moves in the shortest amount of time.

When should you sell a stock for profit?

How long should you hold? Here’s a specific rule to help boost your prospects for long-term stock investing success: Once your stock has broken out, take most of your profits when they reach 20% to 25%. If market conditions are choppy and decent gains are hard to come by, then you could exit the entire position.

How did Warren Buffet get rich? Warren Buffett made his first million by running a hedge fund. Then he switched to owning small banks. Then finally he shut down his hedge fund and put all his money into running an insurance company. An insurance company is a hedge fund that KEEPS the investors money and KEEPS 100% of the profits.

How long should you keep your money in a stock?

In most cases, profits should be taken when a stock rises 20% to 25% past a proper buy point. Then there are times to hold out longer, like when a stock jumps more than 20% from a breakout point in three weeks or less. These fast movers should be held for at least eight weeks.

How long should I hold on to a stock? “Forever” is always the ideal holding period, at least in Warren Buffett’s battle-tested investing philosophy. If you can’t hold that stock forever, truly long-term investors should at least be able to buy it and then forget it for 10 years.