Uber Eats lets you make money by completing food deliveries in your area. In this regard, it’s similar to driving for companies like DoorDash or Grubhub. But, Uber Eats doesn’t pay for gas either. Once again, you’re an independent contractor and are therefore responsible for handling your own operating expenses.

subsequently Do Uber drivers get a tax refund? There is no “uber driver tax refund.” All tax refunds represent an overpayment that is being returned to you. Unless you made the required quarterly estimated tax payments through the year, you aren’t getting a refund unless you qualify for a refundable credit such as the EITC or the Child Tax Credit.

Does Uber pay for insurance? What Does Ride-Sharing Insurance Cover? … Both Lyft and Uber cover the insurance limits in California if you cause an accident. Included in this coverage is $50,000 for each person per accident, $100,000 total injury for each accident, and $30,000 property damage liability.

as well Is working Uber eats worth it? Uber Eats is a convenient way to make some extra cash if you have the vehicle and the time to dedicate. Though there are some problems that you’ll encounter, that’s the case for any place of employment. Overall, it’s worth it to drive for Uber Eats, and the sign-up process is quick and easy.

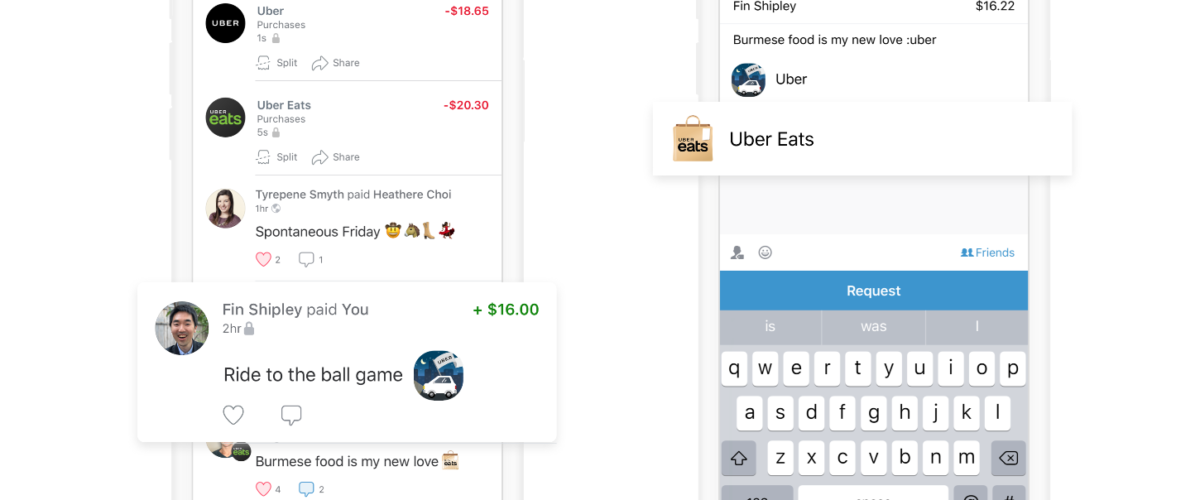

Can UberEATS see your tip?

Yes, delivery drivers and rideshare drivers have their own versions of the app on their phones and they’ll see your tip amount for every Uber Eats order. If customers tip after delivery, the driver will receive a push notification when the tip after delivery is added, and their income breakdown will be updated.

Can Uber driver write off car payment? Your car is considered a business asset when you work as a rideshare driver, which means a portion of any costs associated with it are tax-deductible. This includes your car payment, auto insurance, and licensing, title, and registration fees.

identically Does Uber count as employment? As a category of independent worker called an independent contractor, Uber drivers assume the responsibilities of employment. In other words, Uber drivers usually determine when they are or are not employed, meaning they don’t qualify for normal unemployment benefits.

Does Uber get paid automatically? When you drive with Uber, your earnings are transferred automatically, so you don’t have to worry about paperwork. Find out how to add a bank account and how to cash out.

Will my insurance go up if I drive for Uber?

If you become an Uber or Lyft driver, your insurance will go up, which is why you need to tell your insurance provider that you are working for a ridesharing company. If you do not inform your insurance provider, they may not cover your damages or other costs if you were to get into an accident.

Does Uber eat cover accidents? Uber Eats has liability and collision insurance that covers its drivers while they are driving to pick up food or delivering an order. … If an Uber Eats driver has an accident while online waiting to accept an order, a lower dollar auto insurance policy applies.

Do uber eats get paid hourly?

How much does a UberEATS Delivery Driver at Uber make? The typical Uber UberEATS Delivery Driver salary is $20 per hour. UberEATS Delivery Driver salaries at Uber can range from $11 – $25 per hour.

Why does Uber eats pay so little? Small margins and enough people accept it. Its like a dual sided marketplace. Customers are searching for cheapest delivery, and drivers want big enough fare. If it was too expensive, customers wouldnt order as much.

Do DoorDash drivers get paid?

Drivers delivering with DoorDash are paid weekly via a secured direct deposit to their personal bank account — or via no-fee daily deposits with DasherDirect (U.S. Only). Dashers in the U.S. can withdraw their earnings once daily with Fast Pay ($1.99 per transfer).

Do Uber Eats drivers get paid hourly?

Average Uber Eats Pay Per Hour

On average, a typical Uber Eats driver can make $15 or more per hour. Remember, you will make more money depending on the time and the days you choose to deliver food. The amount of money an Uber Eats driver makes per hour greatly depends on the city they’re serving.

Why do Uber Eats drivers cancel? It’s possible that a delivery person might cancel the delivery if they’re unable to find or reach you. … If a delivery person made a reasonable effort to contact you after arriving at your delivery address, you may not be eligible for a refund.

Do Uber Eats drivers get paid without tips? Does my Tip Go To Uber Eats Drivers or Uber? Good news! Tipping your driver means that you are giving money directly to the driver and not to Uber. While delivery fees go to the company as part of the cost of Uber Eats, the company does not take any of the designated tip money that is meant for the driver.

Do I have to report Uber income?

Do you have to report Uber income? For the majority of you, the answer is “yes.” If your net earnings from Uber exceed $400, you must report that income. You should file a Form 1040 and attach Schedule C and Schedule SE to report your Uber income.

How much of my cell phone can I deduct for Uber? If an expense also benefits you personally, only the portion attributed to your business is deductible. For example, you may have a cell phone that you use for driving about 25 percent of the time. In that case, you can deduct 25 percent of the phone bill as a tax deduction.

Does Uber track miles for taxes?

Drivers don’t deduct all the mileage they’re entitled to

Rideshare platforms like Uber and Lyft tracks some of your mileage, but not all of it — and not nearly everything that you can deduct. Uber and Lyft’s driver app will record on-trip mileage, or how many miles you drive when you have a passenger in the car.

Do Uber Eats get paid hourly? How much does a UberEATS Delivery Driver at Uber make? The typical Uber UberEATS Delivery Driver salary is $20 per hour. UberEATS Delivery Driver salaries at Uber can range from $11 – $25 per hour.

Can Uber Eats see your tip?

Yes, delivery drivers and rideshare drivers have their own versions of the app on their phones and they’ll see your tip amount for every Uber Eats order. If customers tip after delivery, the driver will receive a push notification when the tip after delivery is added, and their income breakdown will be updated.

Why does Uber Eats pay so little? Small margins and enough people accept it. Its like a dual sided marketplace. Customers are searching for cheapest delivery, and drivers want big enough fare. If it was too expensive, customers wouldnt order as much.

Do Uber drivers want to be employees?

Uber and Lyft Drivers Want to Remain Independent Contractors, But Biden Labor Chief Says They Should be Employees. … As noted by Pew, most rideshare users do not consider drivers to be employees.

Does Uber send you a 1099? Uber will provide you with a 1099-MISC if you received at least $600 in other income such as prizes or legal settlement. … You’ll receive an Uber tax summary on your driver dashboard before January 31, 2021. This year’s tax summary will include a record of all your online miles for the year, which may be deductible.

Does Uber pay Social Security?

When you’re an independent contractor, you have to pay all your Social Security and Medicare taxes out of your own pocket. Uber won’t pay half of them for you (employers must pay half of these taxes for their employees, but not for contractors). … You file IRS Form SE with your tax return to report and pay these taxes.